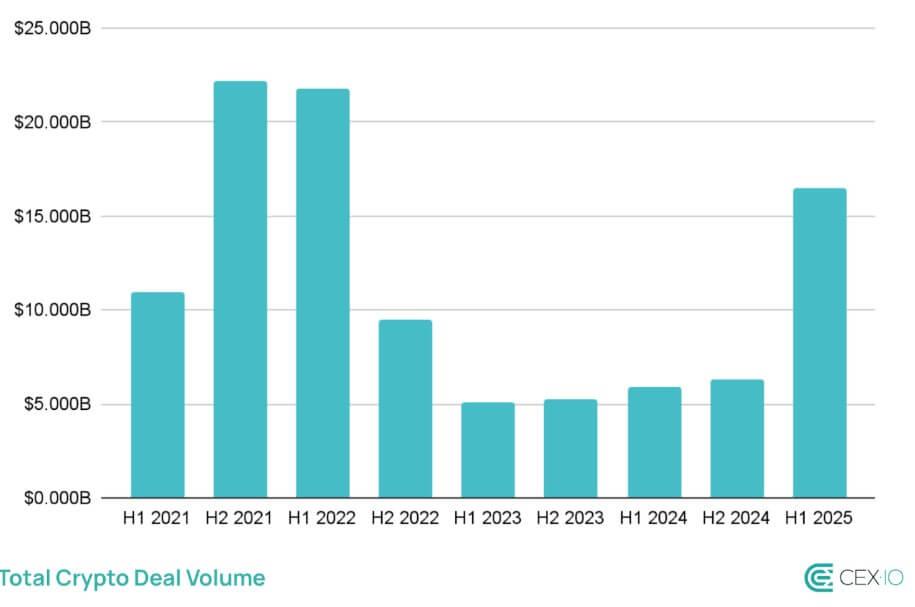

Crypto fundraising is on pace to break records in 2025, with $16.5 billion raised in the first half alone, according to a report from CEX.IO.

According to the report, this has already surpassed the $12.2 billion recorded across all of 2024 and also exceeds the $10.9 billion raised during the 2021 bull run, the industry’s most active fundraising year to date.

Moreover, the substantial fundraising made up 5.3% of global venture capital activity in Q2 2025, the highest share in three years.

CEX.IO noted that this rising number showcases renewed interest following growing adoption trends and a post-election regulatory shift. It also suggests a rebound in investor confidence despite global venture markets remaining cautious.

Tokenless projects gain traction

One of the clearest trends in 2025 is the shift toward quality over quantity. Investors are putting larger sums into fewer projects, with the average deal size reaching nearly $20 million.

This signals growing confidence in experienced teams with sound business models, rather than speculative bets on early-stage ventures.

Meanwhile, another striking development this year is the rise of tokenless fundraising. So far this year, 82% of funded projects raised capital without launching a token.

According to CEX.IO, this shift suggests investors are prioritizing real products, sustainable revenue, and long-term fundamentals.

In contrast, 85% of token-funded projects in 2025 are underperforming on key metrics, a trend that has reinforced caution among investors.

CEX.IO concluded that the move away from token launches and toward operational businesses illustrates a maturing market. According to the firm, investors are now backing ventures that aim to build sustainable products before exploring token models.

Where the money went

finance-related projects, including CeFi and DeFi, received the lion’s share of funding. The projects raised $4.9 billion across 171 deals, or 51.4% of total investments during the period.

Other sectors like infrastructure-focused ventures, including hardware, security, oracles, and bridges, secured 17.9% of the funding.

Meanwhile, consumer-facing applications, artificial intelligence, and DePin projects followed, attracting 14.7%, 5.0%, and 3.1% of funding, respectively.

Another interesting point was that M&A activity has quietly surged, crossing the $6 billion mark, more than triple last year’s figure. CEX.IO pointed out that these deals now account for 36.7% of all crypto transactions.

According to the report, this growth emphasizes the industry’s shift toward consolidation, with companies acquiring existing platforms and technologies to accelerate user growth and strategic positioning.

The post Token raises dying out as crypto fundraising shatters records in 2025 with $16.5B raised appeared first on CryptoSlate.