Bitcoin (BTC) opened 2026 with the kind of price action that tests conviction, with the first five days taking BTC close to $95,000, only for it to test the $90,000 footing again.

The movement follows weeks of choppy trading, failed breakout attempts, and a Fear & Greed Index reading of 28, firmly in “Fear” territory. For traders focused on daily candles, the narrative felt stagnant.

However, beneath the surface noise, institutional demand absorbed twice the amount of new Bitcoin supply entering circulation. This dynamic frames the next several years as structurally bullish regardless of short-term price volatility.

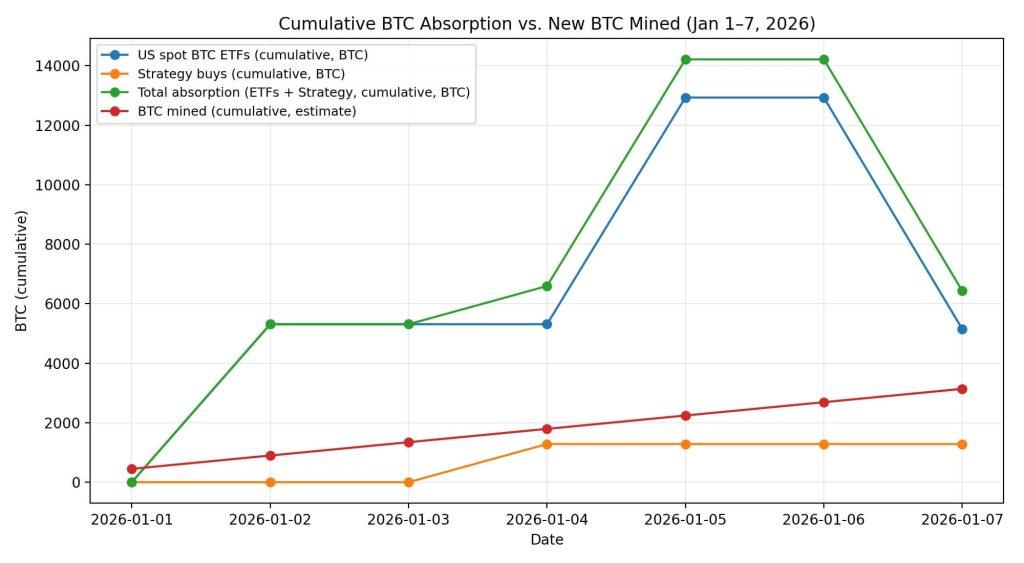

US spot Bitcoin ETFs recorded net inflows of 5,150 BTC as of Jan. 7, according to CoinGlass data. During the same period, Strategy disclosed purchasing 1,283 BTC, bringing its total holdings to 673,783 BTC.

Together, these two visible institutional channels pulled roughly 6,433 BTC off the market while miners produced an estimated 3,137.5 BTC, as Bitbo data shows.

The math is straightforward: institutions absorbed about 105% new issuance in the opening week of the year.

This multiple of absorption offers a cleaner frame for evaluating market structure than price alone. When the multiple runs below 1, the market can clear new supply without drawing heavily on existing holders. At 1 to 2 times issuance, the market enters a steady tightening regime in which the price must periodically reprice to induce selling.

Above 2, a sustained supply deficit emerges, and the market faces what’s effectively a scarcity bid unless flows reverse sharply. The first-week pace sits at the high end of that range, and if maintained, the structural setup would tilt bullish.

Corporate treasuries and long-duration custody

The significance of corporate accumulation extends beyond the raw BTC count.

According to Bitcoin Treasuries, public companies collectively hold 1,094,426 BTC as of early January, representing roughly 5.2% of Bitcoin’s 21 million supply cap. This cohort didn’t exist at a meaningful scale in prior cycles.

Strategy alone controls 673,783 BTC, making it the largest single corporate holder, and its treasury strategy explicitly treats Bitcoin as a long-duration reserve asset with no near-term sell mandate.

Unlike ETF shares, which can be redeemed by authorized participants, coins sitting in corporate treasuries remain illiquid unless boards reverse course. Each corporate purchase compounds the supply constraint because these coins move into custody structures designed for multi-year holding periods.

ETF flows operate differently but produce a similar outcome when net positive.

Spot ETF products allow institutional and retail buyers to gain Bitcoin exposure without taking on custody, and first-week inflows demonstrate continued appetite despite weak sentiment.

Data shows the volatility of daily flows: a 7,620 BTC inflow on Jan. 5 was reversed two days later by a 7,780 BTC outflow, but the net direction remained positive.

When aggregated, these flows represent coins moving from liquid exchange inventory into regulated custody vehicles, tightening the float available for price discovery.

The reflexivity mechanism matters here.

If institutions keep absorbing coins at or above issuance rates, the marginal seller becomes an existing holder who must be induced to part with their position. Price eventually pulls supply from long-term holders, but only when it rises enough to convert conviction into a profit-taking opportunity.

The alternative that existing holders refuse to sell at current prices extends the supply deficit and accelerates the need for repricing.

Scenario grid for the next 12 to 24 months

Projecting forward, the absorption dynamic can be modeled using annualized run rates.

Assuming a baseline issuance of 164,250 BTC per year and 450 BTC mined daily, a conservative scenario in which institutional demand absorbs 0.5 times issuance would result in supply tightening, but not a supply shock.

In a base case where institutions match issuance at 1 times, the market must source additional coins from existing holders to clear, and price becomes the mechanism for balancing supply and demand.

In a bullish scenario where institutions absorb 2 times issuance, 328,000 BTC annually, a persistent deficit emerges, and the probability of step-change repricing increases sharply.

This already happened last year. Data shows that Bitcoin exchange-traded products (ETPs) and publicly traded companies absorbed 696,851 BTC throughout 2025, around 4.2 times the yearly issuance.

Compared with the all-time high of $126,000 registered on Oct. 6, Bitcoin’s price increased 35% amid this supply regime, before shedding the valuation in a year marked by mixed catalysts.

Regulatory tailwinds in the US propelled the crypto industry, while constant macro shocks driven by tariffs and inflation uncertainty kept risk appetite in check.

Back to 2026, the first-week pace offers a stress-test benchmark.

At 5,150 BTC net inflows across four trading sessions, the implied run rate is 1,287.5 BTC per session. Annualized, that pace would produce extraordinary demand, but it’s more useful as an illustration of what sustained institutional appetite looks like than as a forecast.

Even if flows moderate to half that level, the absorption multiple remains slightly above 1, and the structural setup holds.

Long-horizon price targets frame a multi-year bull case

Major investment firms have published price targets that extend well beyond 2026, and their ranges map cleanly onto the absorption scenarios.

VanEck’s capital market assumptions framework projects Bitcoin as a long-duration macro asset with explicit scenario paths reaching into 2050, treating it as a portfolio allocation with multi-decade return potential.

Bitwise published a 10-year forecast calling for $1.3 million by 2035, implying a compound annual growth rate of 28.3% from current levels. ARK Invest’s 2030 scenarios span $300,000 in a bear case, $710,000 in a base case, and $1.5 million in a bull case, all driven by assumptions about institutional adoption and monetary debasement.

Traditional finance firms frame similar bullishness within shorter time horizons.

Standard Chartered maintains a $150,000 target for 2026 despite revising down from earlier estimates, with longer-term projections extending into the $200,000-plus range by decade’s end.

Bernstein reaffirmed $150,000 for 2026 and set a $200,000 peak target for 2027, tying the forecast to a broader tokenization supercycle thesis.

Citi’s most recent note sets a 12-month base case at $143,000, a bull case at $189,000, and a bear case at $78,000. This range accommodates macro uncertainty while anchoring expectations above current levels.

These forecasts span a range of methodologies, including capital market assumptions, supply-and-demand models, and network adoption curves. Yet, they converge on a common theme: sustained institutional demand paired with fixed supply creates a multi-year structural tailwind.

The first-week absorption data validates the demand side of that equation. If ETF inflows stabilize at even half the opening pace and corporate buyers continue deploying capital, the supply-demand imbalance persists, and the price targets become directionally plausible rather than speculative.

| Firm | Horizon | Bear target | Base target | Bull target | Method label | Source |

|---|---|---|---|---|---|---|

| VanEck | 2050 | $130k | $2.9M | $53.4M | Capital Market Assumptions + adoption scenario model (trade settlement + reserve asset penetration) | VanEck (Jan 8, 2026) |

| Bitwise | 2035 | — | $1.3M | — | Capital Market Assumptions (10-year forward return model) | Bitwise (Aug 21, 2025) |

| ARK Invest | 2030 | ~$300k | ~$710k | ~$1.5M | Scenario model (institutional allocation + TAM-style adoption assumptions) | ARK (Apr 24, 2025) |

| Standard Chartered | YE 2026 (and longer-path guidance) | — | $150k (YE 2026); $500k (2030) | — | Bank research forecast (macro + ETF/corporate demand framing) | MarketWatch summary of StanChart note (Dec 2025) |

| Bernstein | 2026 / 2027 peak | — | $150k (2026) | $200k (2027 cycle peak) | Sell-side thematic (“tokenization supercycle” thesis) | Investing.com / coverage of Bernstein note (Jan 2026) |

| Citi | 12-month | ~$78k | $143k | $189k | Bank scenario range (base/bull/bear) | Yahoo Finance coverage (Dec 19, 2025) |

On-chain fundamentals support the thesis

Glassnode’s weekly on-chain analysis tracks the behavior of long-term holders and exchange balances, offering visibility into supply dynamics beyond headline flows.

Exchange inventories have trended lower over the past year as coins move into self-custody and ETF structures, reducing the liquid float available for immediate sale. Long-term holder cohorts, consisting of wallets that haven’t moved coins in 155 days or more, show accumulation patterns consistent with conviction rather than distribution.

These behaviors reinforce the absorption thesis: institutional buyers pull coins into custody structures designed for long-term holding, and retail holders shift toward self-custody as understanding of Bitcoin’s scarcity deepens.

The halving cycle provides the final structural piece.

Bitcoin’s issuance schedule halves every four years, and the April 2024 halving reduced block rewards from 6.25 BTC to 3.125 BTC. At current issuance rates, only 450 BTC enter circulation daily, a figure that will halve again in 2028.

This predictable supply schedule means demand doesn’t need to grow exponentially to tighten the market. It only needs to stay persistently above issuance.

The first-week data suggest demand is doing exactly that.

What matters over the next six months

The bullish case doesn’t require perfect execution or uninterrupted inflows. It requires that institutional demand remain net positive on a rolling quarterly basis and that corporate treasuries continue allocating capital to Bitcoin.

If those conditions hold, the absorption multiple stays elevated, the supply deficit compounds, and the price eventually responds.

The alternative of flows reversing sharply and institutions exiting would invalidate the thesis, but current positioning suggests the opposite.

Public company holdings are at all-time highs, ETF products continue to expand distribution, and long-term holder behavior reflects accumulation rather than distribution.

The price may chop sideways for weeks or months as these dynamics play out. Sentiment may stay weak, and technical resistance may cap rallies.

However, the fundamentals haven’t wavered. Institutions are outbidding new supply at a 2-to-1 ratio, and if that persists, the next several years favor significantly higher prices.

The question isn’t whether Bitcoin reaches a new all-time high, but how long it takes the market to recognize that the supply-demand imbalance has already locked in the outcome.

The post Bitcoin is stalling, but this low-key “absorption signal” shows a violent supply shock could be inevitable appeared first on CryptoSlate.